Introduction

The balanced investment strategies of Nottinghill are Total Portfolio Management, or TPM, and Indexed Total Portfolio Management, or ITPM. Each investment strategy is a widely diversified approach to the management of a taxable individual’s or tax-exempt institution’s overall portfolio. TPM portfolios contain three actively managed components, while all other components consist of securities that perform in line with a stock market index, bond market index, or commodity price. ITPM portfolios, on the other hand, are fully indexed, i.e., contain no actively managed components. In both cases, the low-cost portfolio structure constitutes a conservative approach to balanced portfolio investing. A conservative approach, yet one capable of producing a consistent pattern of benchmark-beating investment returns.

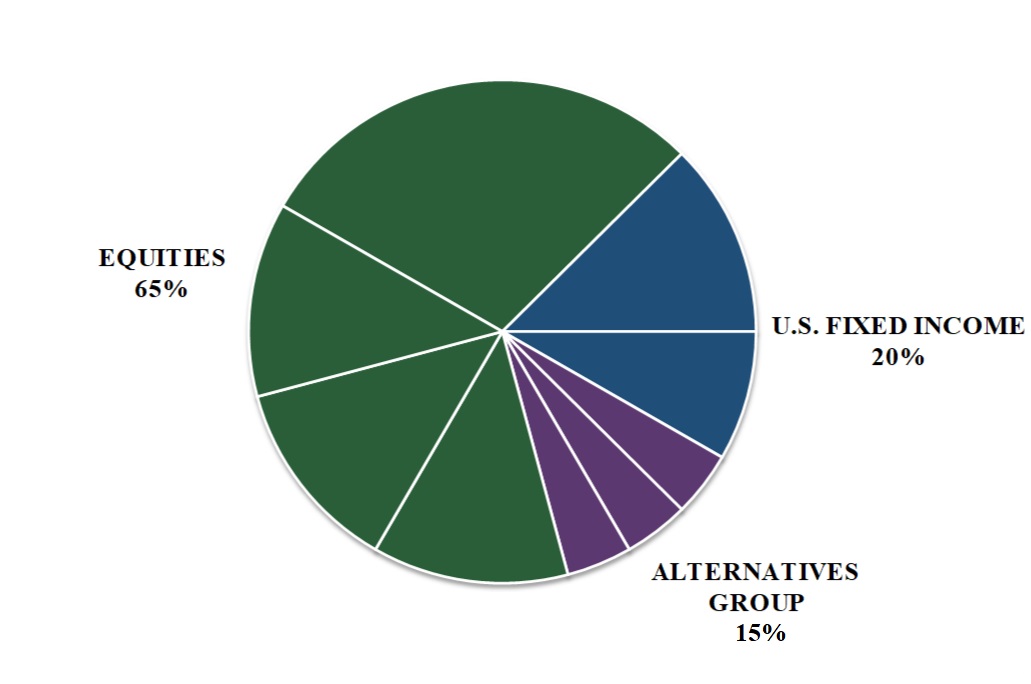

Portfolio Construction

Baseline Structure