February 25, 2022

So, they’ve gone and done it after all. The Russians have taken the next step in the re-establishment of the old Soviet empire, and invaded the rest of Ukraine. Worldwide equities, which already were facing interest rate headwinds, now have very real geopolitical problems with which to contend. In an investment sense, how should we react?

March 9, 2020. We clearly are not dealing with some sort of flu bug – in an effort to contain the spread of a lethal virus, economies everywhere are shutting down. The public health and financial implications are unknown, and U.S. equities are under considerable pressure. Then, as now, we confronted the “how should we react?” question by penning “S-O-Y-H,” and we once again submit the following portion of that earlier March 9, 2020, Perspective to your attention.

“Long before 2000-2002 and 2008-2009, times of considerable stock market stress, there was 1974. One of us actually was managing money in that long-ago time of Watergate, inflation, and high interest rates. With the S&P 500 Index down about 26%, the year was a particularly bad one, and left a lasting impression on someone new to the business. In addition to Watergate, inflation, and high interest rates, a key culprit in 1974 was oil prices at levels that never had been seen before.

U.S. equities took a pounding in 1974. Day-after-day, investors throughout the land assumed the worst, and all but Warren Buffett, who did some of his best buying in 1974, kept selling. Our newly minted investment adviser? He went to one of the older hands at his firm, someone who had seen a lot and learned a lot.

‘I feel as though I should be doing something. What should I be doing?,’ said our boy.

The response: ‘S-O-Y-H, and by that I mean, sit on your hands. This too shall pass.’

And, pass it did. Despite yet another 70s bout of high inflation, high interest rates, and even-higher oil prices, the S&P 500 Index returned about 15% per year between the end of 1974 and the end of the decade.

But, getting back to that brief exchange between the newly minted investment adviser and his learned friend, the wisdom of the latter’s advice always stuck with our boy, and resonates even today, in the time of coronavirus (COVID-19). Last week’s Perspective, ‘Knee-Jerk Reactions Almost Always End Up Being Mistakes,’ is another way of saying the same thing. The message of S-O-Y-H and last week’s message are that we have a compass in the form of a well-researched set of investment disciplines, to keep us headed in the right direction during times of stress.”

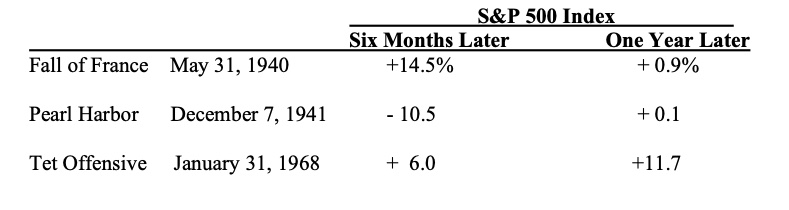

Fast forward two years. In those two short years, COVID (apparently) has been rendered “manageable,” and the U.S. economy is approaching “normal.” But, mankind and womankind never could let well enough alone. A paranoid and expansionist Russia has attacked its neighbor to the west. The known unknowns, in the words of Donald Rumsfeld, are many, and, let’s face it, the unfathomable always is lurking out there someplace. Unlike pandemics, however, geopolitical crises have a fair amount of stock market history associated with them, and that history indicates that the stock market impact frequently is not long-lasting. Three examples:

The first two? Dire straits for the western democracies to be sure. Tet? The western democracies were not in dire straits, but the sobering economic and military ramifications were recognizable immediately. Net-net, not the six-month/one-year collapse that one might have expected. Other examples, we admit, are less comforting. In all cases, however, a number of largely unrelated factors were the real drivers of equity prices in the aftermath of the geopolitical event.

OK, where does that leave us?

The economy. No question, we are getting back to normal with the not totally unexpected getting- back-to-normal bumps in the road. Those bumps include inflationary pressures, which we expect to taper off in the months ahead. That said, oil prices are a significant wild card for reasons unique to the Russia/Ukraine situation, but the bottom line here is that the economy is either fundamentally strong, or getting there.

In a portfolio sense, what’s working, what isn’t? The Ukraine news broke early Thursday (February 24) morning, and the 1974- , 2020-like funk that has been the norm so far this year immediately picked up speed before the markets rallied later in the day. As before (2020), however, almost all of our widely diversified balanced portfolios contain gold (+5% this year) and those much-maligned, yet shock-absorbing Treasuries to which everyone flocks during times of perceived trouble. Our all-equity portfolios, of course, do not contain these other asset classes, but

S&P 500 Index

our all-equity clients, to the best of our knowledge, have total portfolios that are well-diversified. That is the only way to be, as we stress constantly, and by recommending in recent times that everyone maintain a Rainy Day Fund, we have put an exclamation point on the issue of diversification.

Equities. We have no way of knowing if the early-Thursday sell off is going to resume or if the market in fact made a significant mid-day pivot. Irrespective of Ukraine, however, interest rate headwinds remain, and valuations in many stock market sectors are a bit stretched. Cyclical/Value stocks? They are the exception, and we single out Chevron and ExxonMobil in our 10-stock Yield Group for special mention. NASDAQ Growth? As stated many times (and, once again, irrespective of Ukraine), anyone with above-average exposure should reconsider his/her position.

*************

Bottom line, therefore: A stock market that was contending with higher interest rates and inflation now is contending with higher interest rates, inflation, and a newly-emboldened expansionist European power. Outcome uncertain, but geopolitical crises traditionally have not had a long-term impact on equity prices. Regardless, we intend to stick to our investment disciplines, and, instead of doing “something” in the midst of volatility and uncertainty, we plan to abide by the sage advice of our learned friend so many years ago. By the way, the prior statement is exactly how we finished up “S-O-Y-H” (I) in March 2020.